Voluntary takeover bid to acquire shares of Enefit Green AS

An integrated energy group means that Eesti Energia is able to sell the output of both its renewable energy generation capacity and its dispatchable capacity to customers under more competitive conditions.

„Eesti Energia must become an internationally competitive energy group. Both Eesti Energia’s internal and external expert analysis have shown that returning Enefit Green fully to the group is the best solution both for the company and Estonian state to obtain this aim. Repurchase of Enefit Green’s shares would enable us to create an integrated energy group where the portfolios of electricity sales and production are combined. Combining the production capacity of dispatchable capacities and renewables makes it possible to provide a more competitive pricing for electricity sales, increase profitability and restore investment capacity.“

Andrus Durejko

Chairman of the Management Board of Eesti Energia

Terms of voluntary takeover bid

-

Eesti Energia makes the bid with the price of 3.40 euros per one Enefit Green share.

The price has been determined according to the average market price of Enefit Green share at Nasdaq Tallinn Stock Exchange during the past three months (2.68 euros per share) to which a premium of 0.72 euros per share (27%) is added, based on the average of similar transactions.

-

Eesti Energia treats all shareholders equally.

The bid is made with respect to all shares of Enefit Green not yet belonging to Eesti Energia.

Schedule of the bid

| 8 April 2025 at 10.00 | Start of bid period |

| 12 May 2025 at 16.00 | End of bid period |

| 14 May 2025 | Disclosure of bid results |

| 16 May 2025 | Settlement day of the bid |

Before deciding whether to accept the voluntary takeover bid, thoroughly and comprehensively review the voluntary takeover bid notice and prospectus.

With additional questions, you can contact [email protected]

How to accept the voluntary takeover bid, if you wish to do so?

-

1

To accept the voluntary takeover bid, log in to the internet bank or broker platform from which you purchased Enefit Green shares.

-

2

Navigate to the corporate actions section (usually found under Investment Services).

-

3

Accept the takeover bid no later than May 12.

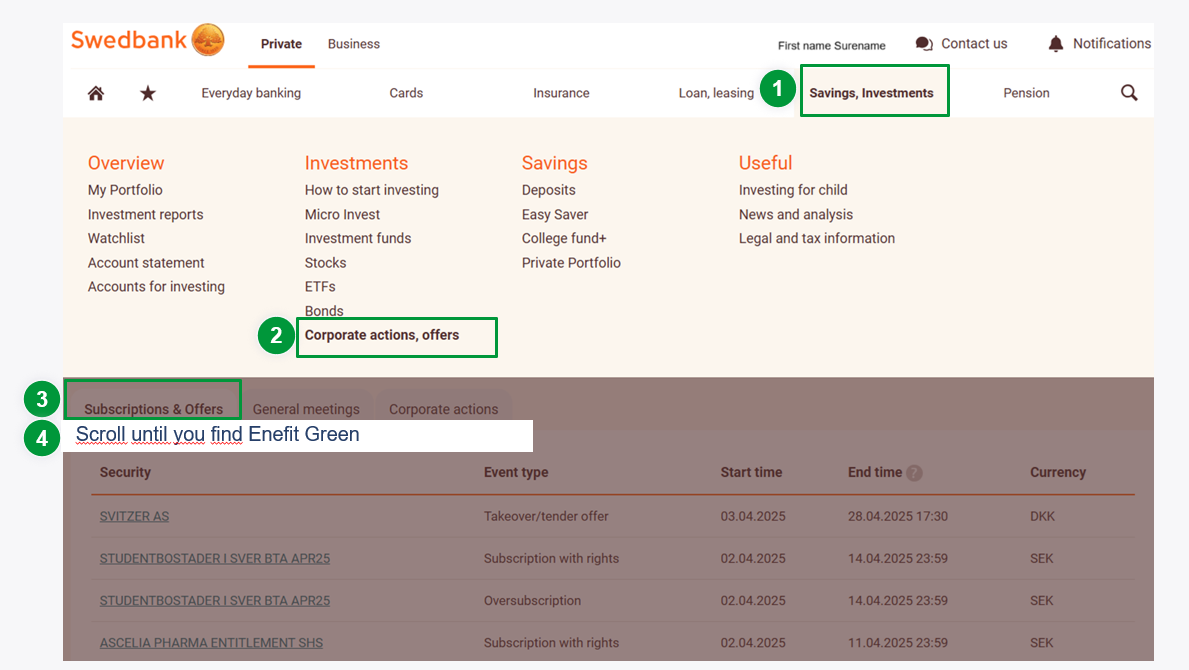

Swedbank internet bank

In internet bank choose:

- "Savings, Investments"

- „Corporate actions, offers“

- „Subscription & Offers“

- Scroll until you find Enefit Green

- Open the tender offer form by clicking on „Enefit Green“

- Insert the quantity

- Confirm

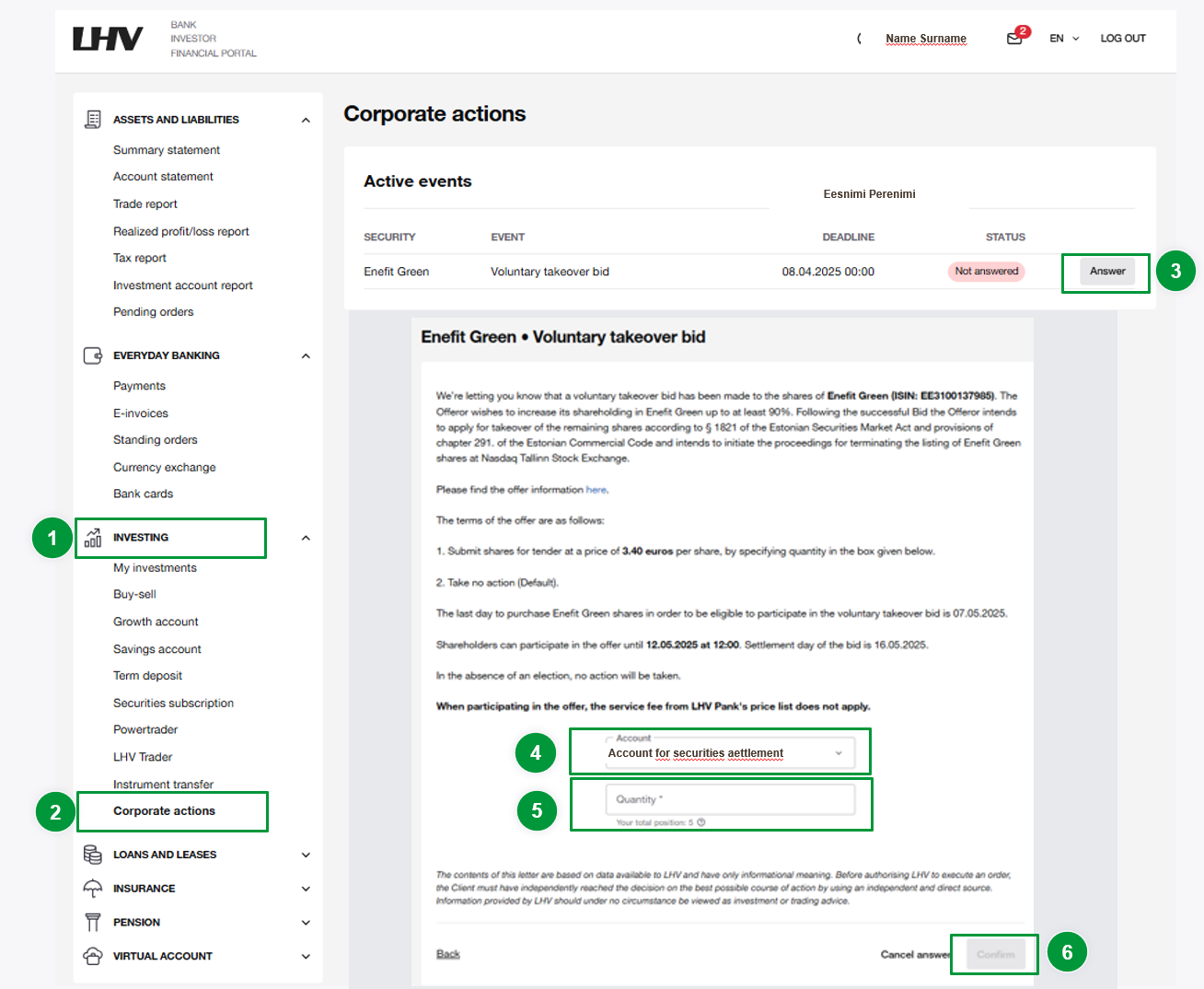

LHV internet bank

In internet bank select sections

- „Investing“

- „Corporate Actions“

- From active events, select Enefit Green

- Select “Respond”

- The offer form will open

- Select the account servicing Securities

- Select the quantity

- Confirm

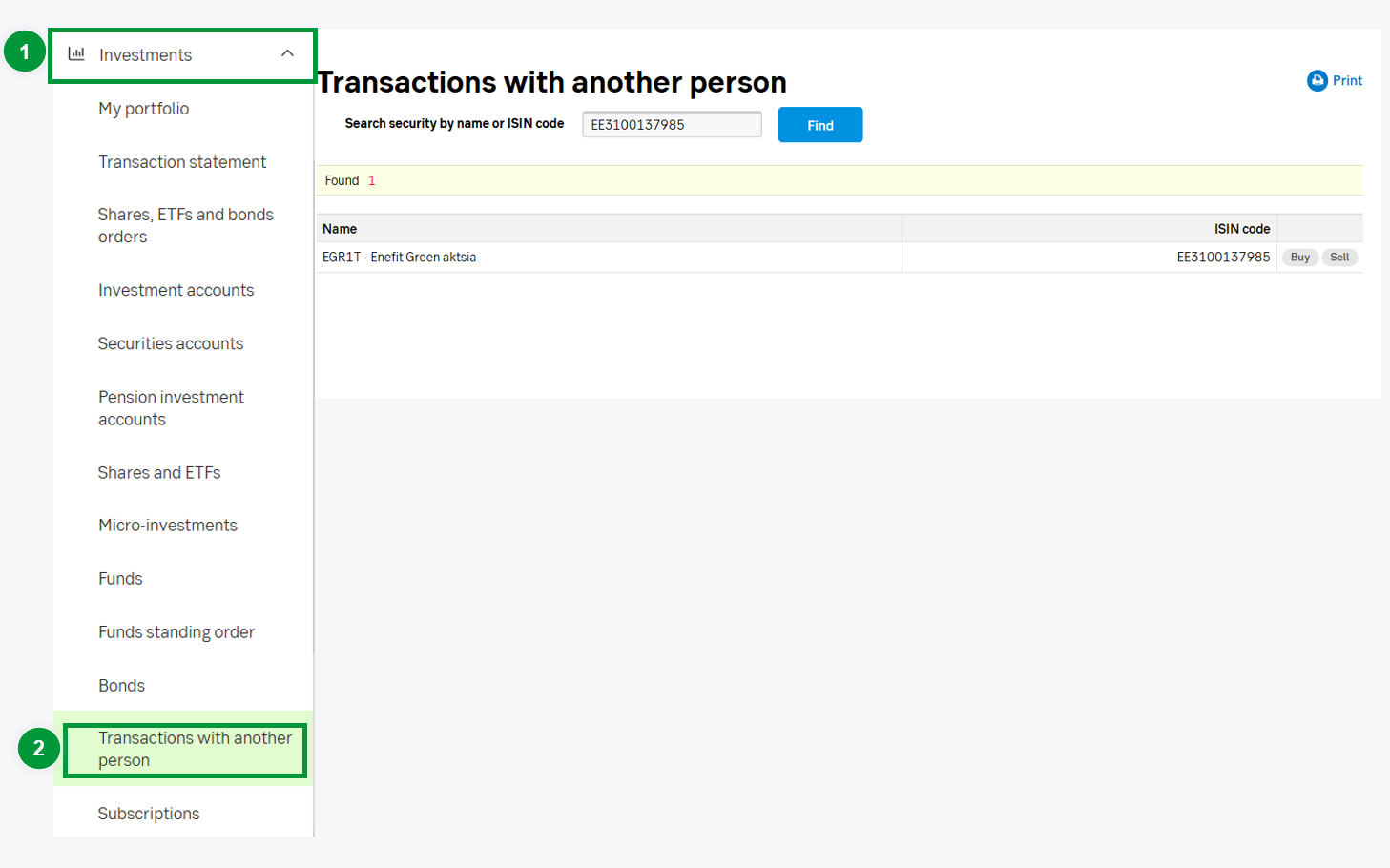

SEB internet bank

In internet bank choose:

- „Investments“

- „Transactions with another person“

- Search Enefit Greeni by ISIN code: EE3100137985

- Click on button „sell“

- Detailed instructions on how to accept the takeover offer are described in the notice

Frequently Asked Questions

A voluntary takeover bid is a public bid to the shareholders of the target issuer, Enefit Green AS, to acquire Enefit Green shares for cash. The takeover bid is made by Enefit Green AS's majority shareholder, Eesti Energia AS.

Eesti Energia has thoroughly analysed the company's internal and external environment over the past year. The energy market has changed, and an independent energy production company without close cooperation with retail business is not competitive in the long term. To increase the group's long-term competitiveness, one important solution is to bring Enefit Green fully back into the group, which allows to increase the production portfolio and a higher return on investments.

The basis for determining the price of the voluntary takeover bid was threefold: market analysis, price targets from analysis houses, and the opportunity for shareholders to exit the transaction profitably. Eesti Energia is making a takeover bid to Enefit Green shareholders at a price of 3.4 euros, which is 47% higher than the market closing price on March 26, 2025, and 27% higher than the three-month average.

Retail investors can accept the takeover bid starting from April 8, 2025, through their internet bank or the broker platform from which they purchased Enefit Green shares. We recommend that shareholders monitor bank notifications or view the guidelines here.

If Eesti Energia acquires at least 90% of all Enefit Green shares through the voluntary takeover bid, the remaining shares will be taken over for monetary compensation. The principles of share takeover (e.g., price) are described in the Securities Market Act and the Commercial Code.

The acceptance period for the voluntary takeover bid ends on May 12, the results will be announced on May 14, and the payment will be credited to the accounts of investors who accepted the bid on May 16. .

With additional questions, you can contact [email protected]

Watch the recorded webinars aimed at Enefit Green investors

Eesti Energia AS plans to carry out a public offering of its bonds

Eesti Energia plans to offer the opportunity to invest in Eesti Energia’s bonds with an intention to list the bonds in the main list of the Nasdaq Tallinn Stock Exchange. The bond offering is planned to take place after the completion of voluntary takeover bid of Enefit Green shares, according to the preliminary schedule, in the second half of May. A prerequisite for a public offering is the Financial Supervision and Resolution Authority approving the public offering and listing prospectus.

Would you like to stay informed about Eesti Energia's public offering of bonds on the Nasdaq Tallinn Stock Exchange's Baltic bond list?

The Bid is being made in accordance with the laws of the Republic of Estonia and will not be subject to any review or approval by any foreign regulatory authority. The Bid is not being made to persons whose participation in the Bid requires an additional document to be prepared, a registration effected or that any other measures would be taken in addition to those required under the laws of the Republic of Estonia.

The Bid is made in accordance with the Bid Prospectus and Notice approved by the Estonian Financial Supervision and Resolution Authority (EFSA). Any person considering participating in the Bid must make their own assessment on the Bid by acquainting themselves fully with the Bid Notice and the Bid Prospectus, by analysing independently the economic activity, financial situation, and circumstances of Enefit Green AS and its subsidiaries and the Offeror’s plans for the activities after the acquisition and if necessary, consult an expert. This is not a recommendation by either the Offeror or by any other person to sell any Enefit Green shares. The Takeover Bid Prospectus and Notice have been drawn up and approved in Estonian, in addition an unofficial translation into English has been published. In the event of any inconsistency between the Estonian and English language versions the Estonian language version shall prevail.

The reference to the intent to make a bond offer as described in this website does not constitute a public offer of securities under Estonian law including Regulation (EU) 2017/1129 (Prospectus Regulation) and it is not a prospectus. Bond offer shall only take place under a bond prospectus that must be approved by the EFSA. Eesti Energia AS has initiated the proceedings to obtain EFSA’s approval to the bond prospectus, however, there is no certainty that the EFSA shall approve it. Eesti Energia AS has no obligation to make the bond offer and may at any time withdraw from making the bond offer, cancel it or amend its conditions.

Information contained on this website is not for release or distribution, directly or indirectly, in or into any jurisdiction where to do so would be unlawful or to persons or jurisdictions who are subject to financial sanctions imposed by competent authorities. Persons who have gained access to this website or any other related documents (including custodians, nominees and trustees) must observe these restrictions and must not send or distribute the information on this website in or into the relevant jurisdictions or to relevant persons.